Report shows Qatar and the UAE are market leaders in hotel guest satisfaction in Q1 2023

- Mabrian and Katalysts launch the inaugural Middle East Tourism Barometer – a new travel and tourism data resource delivering quarterly reports

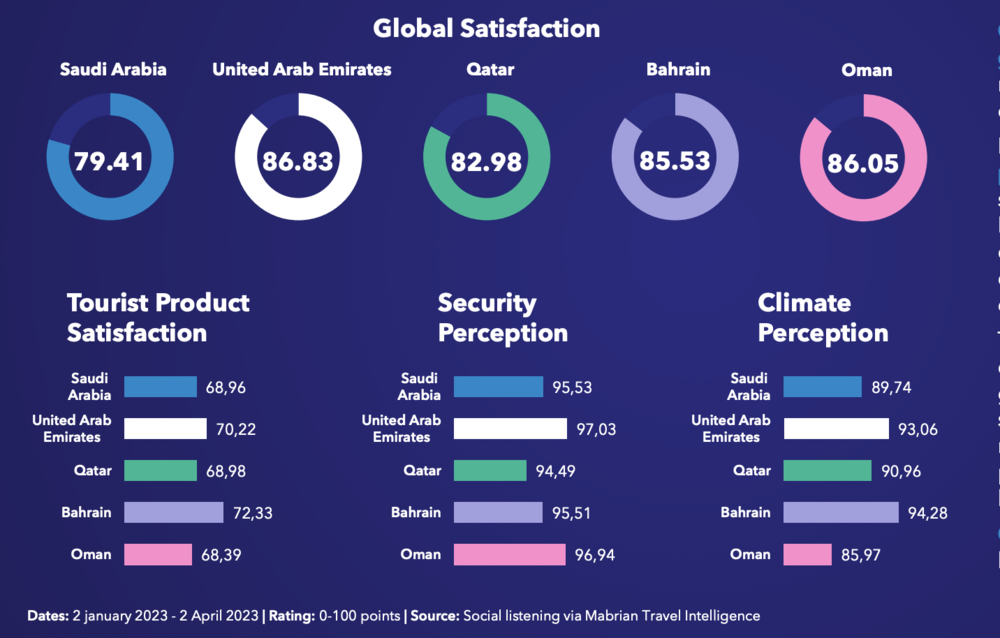

- In Q1 2023, Oman and the UAE rank as top performers in global perception

- Qatar leads in guests satisfaction within three-star hotels; the UAE leads in five-star hotels

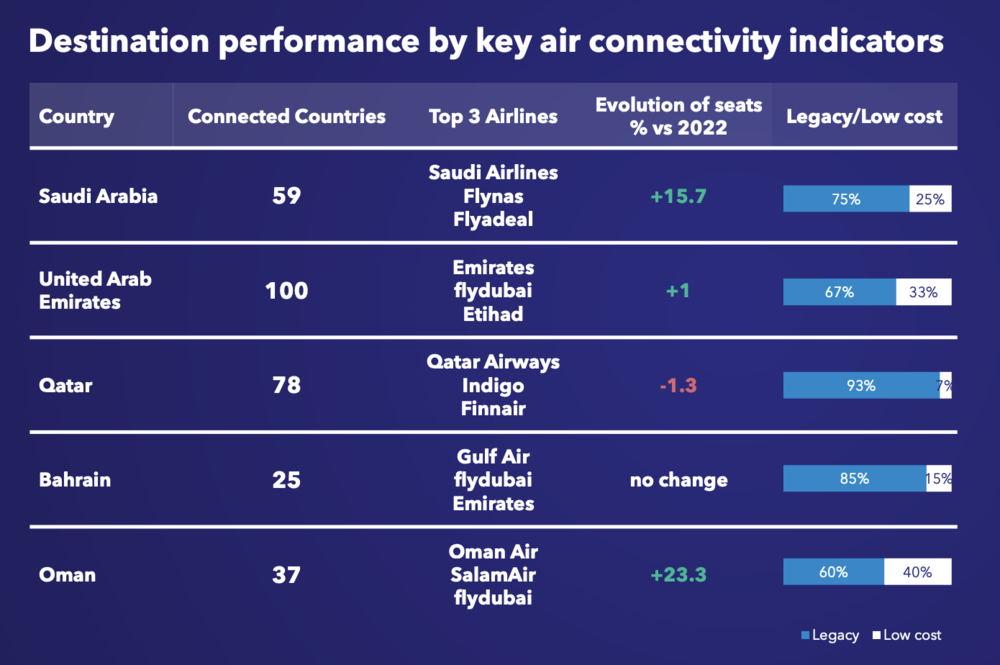

- Air connectivity caused tourism growth in Oman and Saudi Arabia

- Art and culture emerge as the dominant tourist interests in the region

Mabrian, a leading provider of travel intelligence solutions, has partnered with Katalysts, a renowned data analysis firm, to launch the Middle East Tourism Barometer, a comprehensive quarterly report that aims to provide invaluable insights into the regional tourism industry.

The Middle East Tourism Barometer presents a detailed analysis of key factors impacting the tourism sector, including global tourist perception indexes, tourist interest distribution, destination performance by key air connectivity indicators, hotel satisfaction index versus hotel prices, and hotel composition distribution.

The inaugural quarterly report shows that in Q1 2023 Oman and the UAE ranked as top performers in terms of tourism product in categories including Arts & Culture, Food & Cuisine, Family Activities, Active Lifestyle, Nightlife, Sunbathing, Wellness, Shopping and Nature.

While the UAE also scored the highest guest satisfaction ratings across its five-star hotels, Qatar hotel's performed best in the three-star hotel category. Saudi's hotels showed the lowest guest satisfaction ranking in four- and five-star hotels, with the tourism industry in its infancy, but figures are expected to spike as new luxury resorts open up in the region.

Destination performance by key air connectivity indicators also showed an interesting trend. Oman and Saudi Arabia have experienced remarkable progress in increasing the number of inbound seats, with Oman showing a growth of 23.3% and Saudi Arabia 15.7% vs 2022.

Although Saudi Arabia's connectivity is still trailing behind Dubai, the country is making significant strides in increasing its connectivity. The figures might change rapidly in the upcoming months, as Saudi Arabia, in its efforts to attract 100 million tourist, includes enhancing its infrastructure, developing new tourist destinations, and increasing the capacity of its airlines.

In the same vein, the government has announced the launch of a new airline, Riyadh Aid, in March, and the STA and Ministry of Tourism have invested in initiatives aimed at encouraging airlines to expand their capacity within the country.

The study also found that art and culture have emerged as the main drivers of tourism, while air connectivity has seen remarkable growth in Oman and Saudi Arabia.

Breaking Down the Data: Indices Definitions

GTPI (Global Tourist Perception Index): This index measures the overall level of visitor satisfaction with the destination. This combines the Hotel, Product, Security and Climate indices and analyses the distribution of general sentiment about the destination.

TPI (Tourist Product Satisfaction Index): This index, based on tourist mentions on social media, measures the level of satisfaction with the following products on offer at destination: Arts & Culture, Food & Cuisine, Family Activities, Active Lifestyle, Nightlife, Sunbathing, Wellness, Shopping and Nature. This index is obtained by analysing the distribution of positive, negative and neutral comments that are made in relation to each of these products on social media through Natural Language Processing techniques.

PSI (Perception of Security Index): This index measures the level of security perceived by visitors, based on tourist mentions on social media. This index is calculated using advanced Natural Language Techniques that allow to understand when a comment on social media refers to these issues as well as the sentiment of the mention.

PCI (Perception of Climate Index): This index, based on tourist mentions on social media, measures the level of visitors´ satisfaction with the climate at the destination using Natural Language Processing techniques. This is achieved by measuring the volume of complaints on social media, that is, negative comments regarding the meteorology at destination and setting an inverse relationship: the lower the volume of negative comments, the higher the satisfaction index. This allows us to understand the relationship between the expectations of the visitors and the reality of the destination.

HSI (Hotel Satisfaction Index): This index, based on reviews on hotel portals, measures the level of tourist satisfaction with hotels at destination for three-, four- and five-star hotels, based on comments made on TripAdvisor, Booking and Expedia. It is calculated using Natural Language Techniques to understand the sentiment of mentions.

Indices scale

The indices show values between 0 and 100 points. Below is the rating

scale to know the meaning and evolution of the indicators over time.

- From 0 to 24 points: The indices in this scale, show very low levels of satisfaction and confidence and are therefore a priority area for revision.

- From 25 to 49 points: Relatively low level of satisfaction and confidence. Significant potential for improvement.

- From 50 to 74 points: Good to very good satisfaction level. Moderate potential for improvement.

- 75 to 100 points: Excellent levels of satisfaction and confidence. In some cases there is room for improvement, although in most of them these are levels to maintain and consolidate.

Sources available on request. For more information, visit www.mabrian.com and mabrian.com/blog/middle-east-barometer/

_w=940_h=488_pjpg.jpg?v=e5490446)

_w=640_h=335_pjpg.jpg?v=e5490446)

_w=640_h=335_pjpg.jpg?v=e5490446)

_w=640_h=335_pjpg.jpg?v=e5490446)

_w=640_h=335_pjpg.jpg?v=e5490446)