Expert data reveals key steps to attract more tourists to the Gulf

Following the launch of the 2025 Connecting Travel Insight Report at Arabian Travel Market (ATM), global travel intelligence platform and data partner Mabrian has identified four key trends shaping the GCC tourism landscape and impacting arrival numbers.

More than 70 pages long, the indepth report powered by Mabrian, reveals the trends behind the GCC’s evolution into a top-tier tourism destination and identifies growth opportunities, from leveraging air connectivity to refining guest experiences.

“We’ve taken a microscope to the travel and tourism landscape to monitor growth and identify opportunities,” said Connecting Travel’s Editorial Director, Sarah Hedley Hymers, at the unveiling of the report.

More than 100 VIP guests, including keynote speaker John Bevan, CEO, dnata Travel Group, and Carlos Cendra, Partner and Chief Marketing Officer of Mabrian, attended the report launch at the Fairmont Dubai.

This is the second consecutive year Mabrian has provided data for the Connecting Travel report, drawing from more than 30 global sources and four key takeaways were identified.

RELATED:

Connecting Travel launches 2025 Insight Report at ATM in Dubai

Free: Download the 2025 Connecting Travel Insight Report

Groundbreaking new event to drive cruise growth in Gulf region

1 Leverage air connectivity edge to boost inbound travel

The GCC’s rapid rise to global tourism prominence is underpinned by strong air connectivity. Saudi Arabia, the UAE and Qatar form a robust connectivity triangle, driven by consistent international air capacity growth since 2019, up +38%, +14.5%, and +14%, respectively, according to Mabrian’s air capacity data. Reinforcing air connectivity during the shoulder seasons (with milder temperatures) or through seasonal routes operated by low-cost carriers could support the goal of increasing long-haul leisure arrivals, not just for these countries, but for other GCC destinations such as Oman and Bahrain.

“The next step is to leverage this strategic advantage to pursue three key goals: increasing long-haul leisure arrivals and stays; aligning with seasonal demand through customised, crafted experiences; and exploring new demand segments to boost visitation,” said Mabrian.

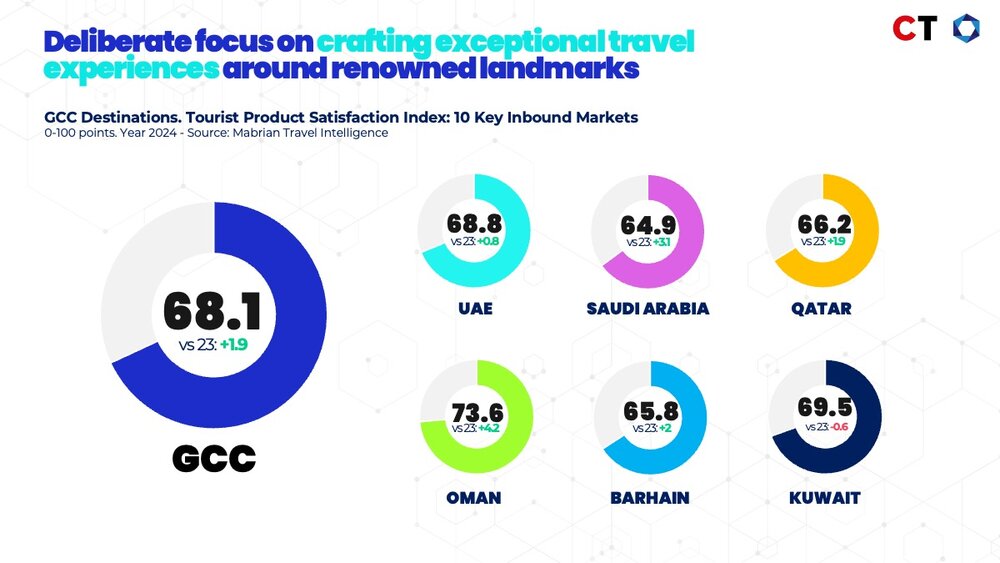

2 Focus on crafting exceptional travel experiences and adventure as core differentiators

The report guides readers through the array of experience-led projects being developed across GCC countries, highlighting how these attractions blend local heritage, cultural richness and international brands to appeal to travellers worldwide. However, Mabrian’s Tourist Product Satisfaction Index (TPI) raises a red flag on a critical issue: for GCC countries to successfully position themselves as premium destinations for high-value, repeat visitors, they must prioritise the quality of experiences, especially by delivering world-class, on-site service.

“TPIs from benchmark destinations for the GCC, such as Singapore, Thailand, Turkey and the Seychelles, range from 70 to 75 out of a possible 100 points, whereas the GCC average stands at 68.1,” said Mabrian. “The good news is that all GCC destinations are showing an upward trend in this index, indicating they are on the right path and should continue to build on this progress in the months and years ahead.”

Mabrian data

Mabrian data

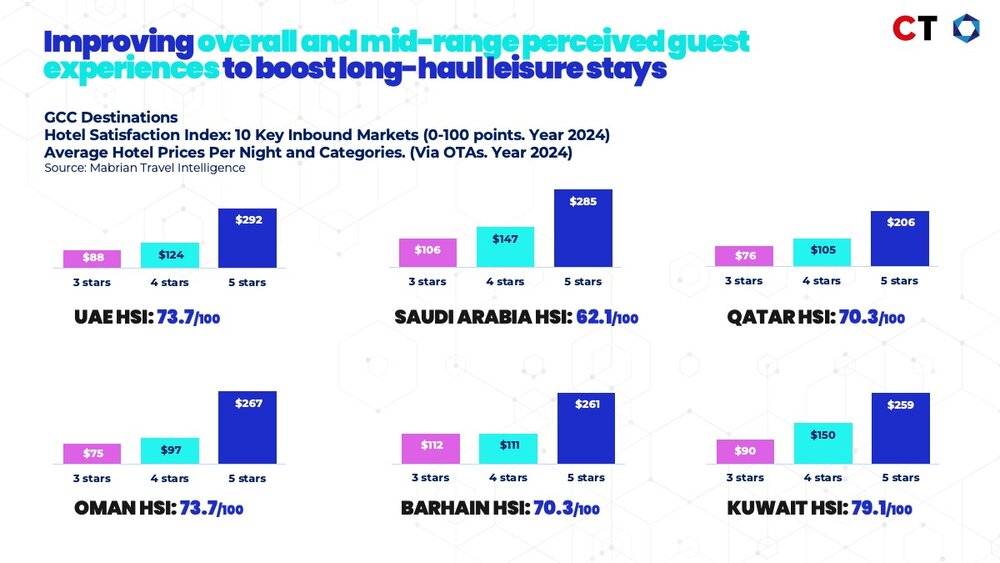

3 Improve overall and mid-range perceived guest experiences

In order to achieve sustained growth, overall satisfaction with accommodation is essential for increasing leisure arrivals and encouraging longer stays, yet Mabrian’s Hospitality Satisfaction Index (HSI) scores for Saudi (62.1 out of 100), and Qatar and Bahrain (70.3) reveal areas for improvement. This means investing in guest experience not only in luxury segments but also across lower categories, and diversifying hotel development to include upscale and mid-upscale options in both urban and resort settings.

“Guest satisfaction must extend beyond the luxury segment, particularly in upper midscale and upscale hotels. If the guest experience does not meet international standards, it may discourage travellers from considering GCC destinations as viable, long-stay holiday options,” said Mabrian.

Mabrian data

Mabrian data

4 Tap into uncharted segments to seize and capture leisure global demand

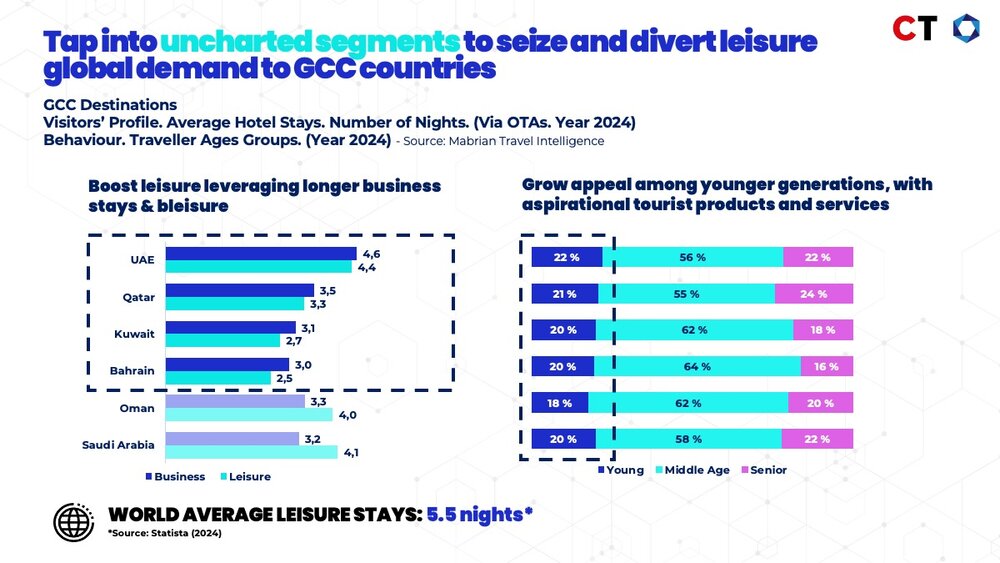

Mabrian data featured in the 2025 CT Insight Report also highlights the potential of key demand segments to boost leisure travel in the region, particularly the bleisure segment and younger generations.

Travellers to the GCC display a distinct behavioural pattern that sets them apart from other markets, with business travellers consistently recording longer average stays than leisure visitors.

“This trend, observed over the past two years, suggests that these destinations are successfully capitalising on the bleisure opportunity among international travellers,” said Mabrian.

Saudi Arabia and Oman are exceptions, where the balance tips in favour of leisure travellers. In Saudi, leisure visitors stay an average of 4.11 days, compared to 3.18 days for business travellers, while in Oman, business stays are slightly shorter than those of leisure guests.

“To strengthen the bleisure segment, GCC countries should enhance mid-range accommodation options and align hotel experiences, especially in top-tier categories, with global standards,” said Mabrian

Mabrian data

Mabrian data

With just 1 in 5 visitors to GCC destinations aged between 18 and 35, there is also significant growth potential in boosting the arrivals of younger travellers. As well as expanding lodging options in midscale and economy categories, Mabrian suggests the offer of aspirational tourism products and services that resonate with their interests.

“Keeping this segment engaged could make a substantial impact in both the near and long term,” added Mabrian.

The 2025 Connecting Travel Insight Report is now free to download here. As well as sharing exclusive data and developments shaping inbound and outbound tourism to and from the GCC region, the report highlights hotel openings and new attractions, as well as infrastructure and policy changes set to impact the GCC. Moreover, 10 of the leading outbound destinations for GCC markets are featured in the report, making it essential reading for the travel trade.

For more information, visit www.mabrian.com and www.connectingtravel.com

DOWNLOAD OUR FREE 76-PAGE CONNECTING TRAVEL INSIGHT REPORT TODAY

_w=940_h=488_pjpg.jpg?v=e5490446)

_w=640_h=335_pjpg.jpg?v=e5490446)

_w=640_h=335_pjpg.jpg?v=e5490446)

_w=640_h=335_pjpg.jpg?v=e5490446)

_w=640_h=335_pjpg.jpg?v=e5490446)